Mastering the Fourth Industrial Revolution

The banking industry must learn to be agile and forward-thinking when responding to evolving client demands and technological advancements, such as the Internet of Things and Big Data.

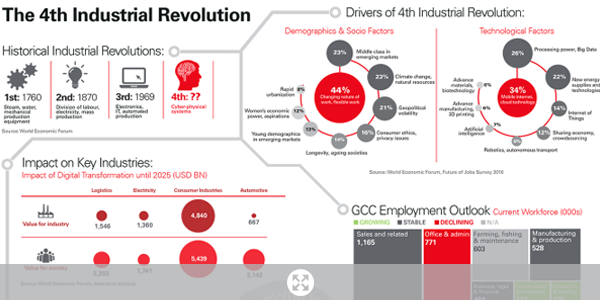

With the Fourth Industrial Revolution upon us, companies will be connected to customers like never before. This latest industrial revolution refers to the next stage of technological innovations such as the Internet of Things (IoT), AI, 3D Printing and the use of Big Data. The rapid growth in technology was the theme of this year’s World Economic Forum annual meeting at Davos, Switzerland. More than 2,500 leaders from across business, government, academia and the arts converged on Davos for the forum, which centred on “Mastering the Fourth Industrial Revolution“.

Global spending on the Internet of Things (IoT) will rise 17 per cent in the next few years, a new prediction by market analyst team IDC says, which means spending will rise above $1.3 trillion. Primarily driven by industries such as telecoms, transport and manufacturing, this new wave of spending is anticipated to include the consumer, banking and healthcare sectors, as well as insurance.

While the First Industrial Revolution brought about a period of innovation that lasted more than 100 years, each subsequent revolution has lasted less than half as long as the one that preceded it as the pace of innovation quickens.

The IoT refers to the greater connectivity of electronic devices like computers, tablets and mobile phones, and their ability to share data automatically. Researchers at Gartner forecast that there’ll be 20.8 billion connected ‘things’ by 2020, while others are more bullish – Cisco predicts 50 billion connected devices by the end of the decade. Such greater interconnectivity will have a huge impact on society, while fundamentally changing customer relationships. It is also expected to make financial systems and markets run more efficiently. In the financial world, changes are already happening to make global payments quicker and simpler, as the industry adopts new innovations. Technology should also help new entrants quickly establish start-up businesses in developing countries.

“It is possible to imagine multiple ways in which the IoT can enhance banking – for example, wearables could provide biometric authentication; payments can be embedded within household items; and geo-targeted offers could expand into a more personalised service, while providing increased security. However, the exact enhancements that customers want will depend on the direction that the implementation of the IoT ultimately takes. Each of these devices will be more powerful, interacting with customers by voice, and acting as their personal assistants. We see with the mobile how an intelligent portable device has quickly changed the type of interactions we have with our customers. It is still early days,” said Christophe Chazot, Group Head of Innovation at HSBC.

“Consider that these technologies have exponential potential”, he continued, “they feed on the successes of each of the other of the technologies – and that means the pace of change is likely to be slow right up until it is not. I firmly believe that it is only a matter of time until we see these new technologies becoming a major part of all our lives“.

On the supply side, many industries are anticipating the introduction of new technologies that will create entirely new ways of serving existing needs while significantly disrupting existing industry value chains. And on the demand side, growing transparency, consumer engagement and new patterns of consumer behaviour will force companies to adapt the way they design, market, and deliver products and services.

“To win in this new business environment, where entire systems of production, distribution, and consumption are transforming before our eyes, a change in mind-set is needed. What got companies to where they are now will not necessarily serve them well going forward. The status quo is no longer a comfortable place to be,” said Diane Reyes, Global Head of Payments and Cash Management at HSBC.

At the heart of the Fourth Industrial Revolution is data, which has been described as “the new oil“. Big Data is still in its nascent stage as businesses learn how to collect it, analyse it and then use it for a competitive advantage.

Data is fast becoming an asset no company can survive without. Every transaction, interaction or experience comes with a digital footprint. Businesses are quickly recognising that this data can create new revenue streams and fuel new digital ecosystems. Those companies already harnessing this data and thereby embracing the Fourth Industrial Revolution, naturally have a leg-up on the competition.

The use of Big Data has huge potential for the banking sector. “As an industry, we are privy to huge quantities of sensitive personal and corporate information and the new techniques that are emerging provide an opportunity for us to add huge value to our client/customer relationships. We are very excited at HSBC in particular because our uniquely global business means we are exceptionally well placed to bring insights from a huge range of global value chains,“ added Mr Chazot.

These are exciting times and new technologies are being created at breakneck speed, providing plenty of opportunities to adopt them across all HSBC global businesses and functions. Some examples of where the bank has already innovated include, a messaging system that alerts customers when their accounts are in debit so they can act to avoid paying fees; “HSBC Nudge”, an app currently under global development, that aligns financial behaviour with people objectives using Big Data and behavioural economics, as well as market insight developed by analysing payment flows across country corridors. HSBC is also developing an app that helps corporates benchmark and optimise their working capital.

The high volume of structured and unstructured data also assists in internal fraud prevention, preventing criminals from entering the financial system using sophisticated network analytics, together with major universities and government research centres.

Alongside these innovations, customers want security in the protection of their financial lives, low friction access to credit and their own deposits, plus the reliable execution of their transactional needs.

“We must learn to be more agile and forward-thinking when responding to evolving client demands and technological advancements by way of internal innovation and external tie-ups where speed to market is improved and products are optimised”, concluded Ms Reyes.